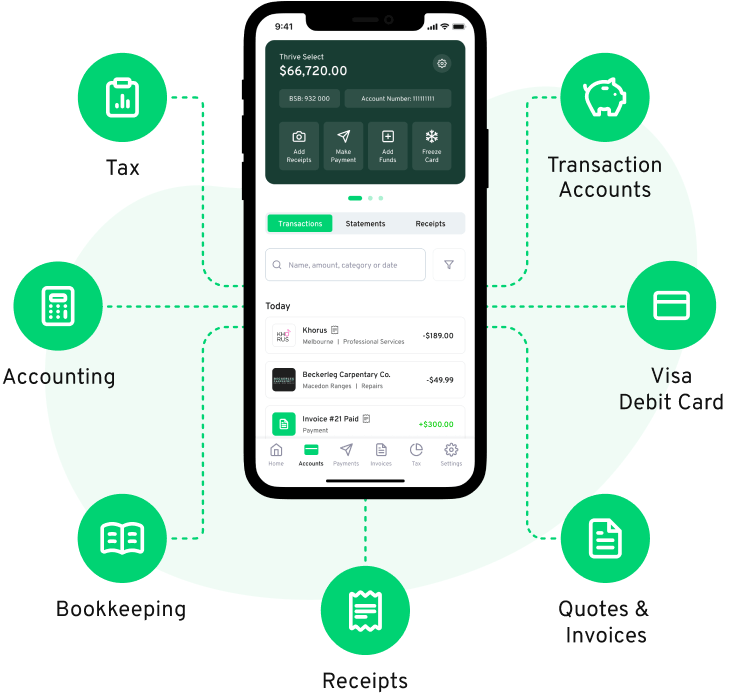

Community First Bank is a local financial institution deeply rooted in the neighbourhoods it serves. It priorities the well-being of its community by fostering close relationships, offering personalised financial solutions, and investing in local initiatives. Thriday, on the other hand, stands out as a superior choice due to its innovative approach. Thriday combines traditional banking with cutting-edge technology, enabling seamless online and mobile banking experiences. It empowers customers with convenient tools like tax estimates, cash flow forecasts and invoicing. While Community First Bank values personal connections, Thriday's digital prowess provides greater accessibility and modern banking solutions, making it the better choice for today's tech-savvy consumers.

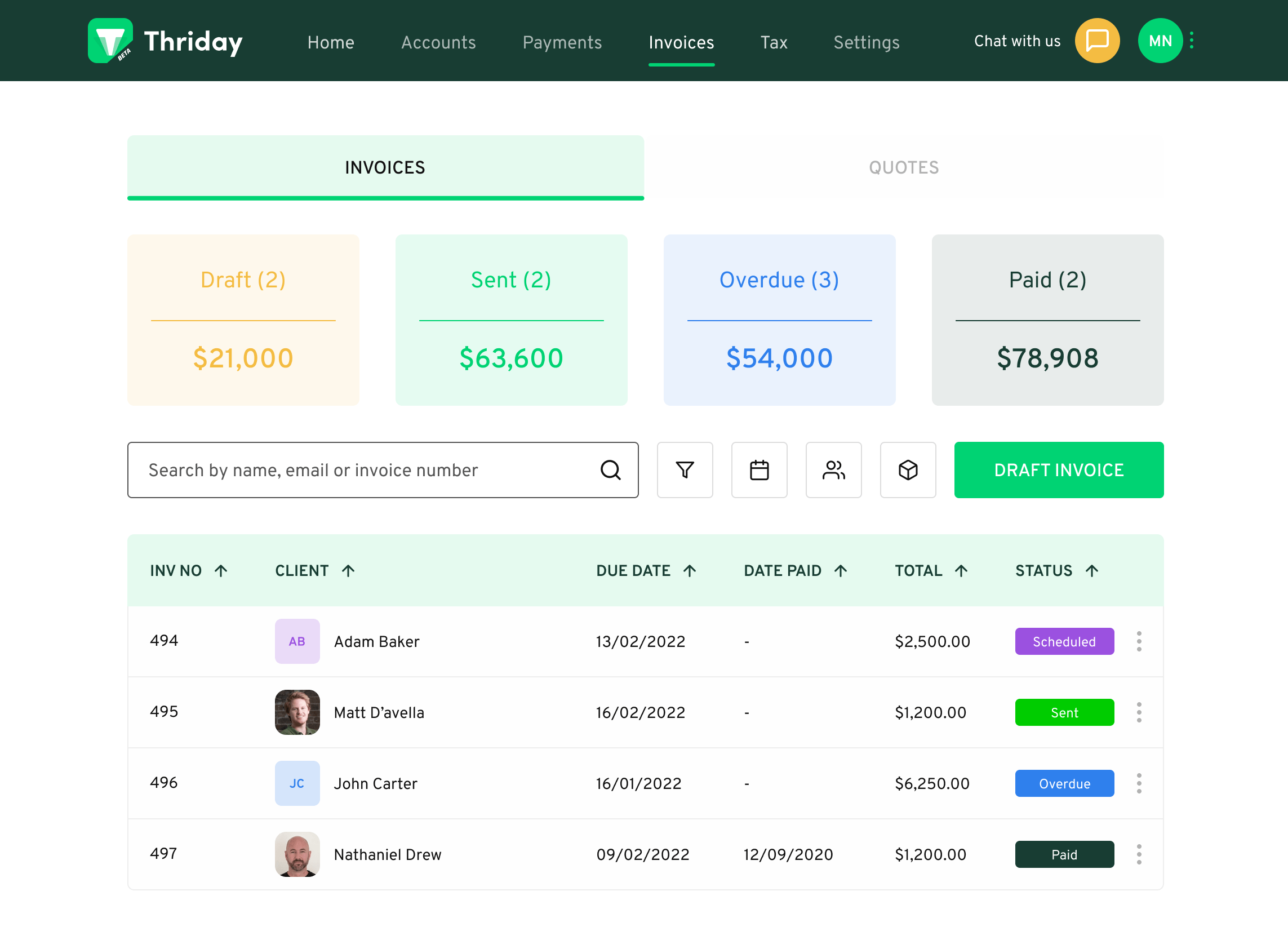

Thriday has gained immense popularity among small businesses for its AI-powered automation of banking, accounting, and tax processes. Thriday's intuitive platform streamlines financial tasks, reducing manual handling and minimising errors. Small businesses appreciate the time and money saved, allowing them to focus on growth. Thriday's AI algorithms analyse financial data, ensuring compliance with tax regulations and providing valuable insights for informed decision-making. With its user-friendly interface and comprehensive features, Thriday has become the go-to solution for small businesses in Australia.