ANZ is considered the smallest of Australia's traditional big 4 banks. ANZ has traditionally struggled to provide comprehensive business banking services and recently sold out of its merchant terminal business. For most business owners, the big banks do little more than hold onto their funds. Given the depth of richness of data available to them, it's hard to fathom why ANZ would not provide deeper insights to help businesses succeed. This is one of Thriday's real strengths. By building its solution from a blank canvas, Thriday recognised the importance of data, and Thriday customers can benefit for real-time insights such as cashflow forecasts and tax estimates.

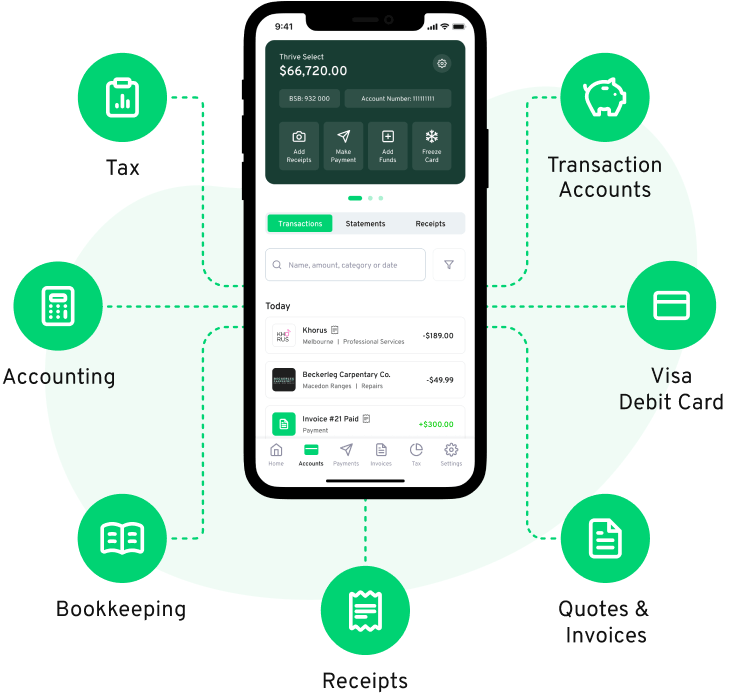

Do you get a power outage every time you look at a shoebox of receipts? Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – paying tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of everything you, leaving you in control, and all the power at your fintertips. Don’t waste another minute, get started now.