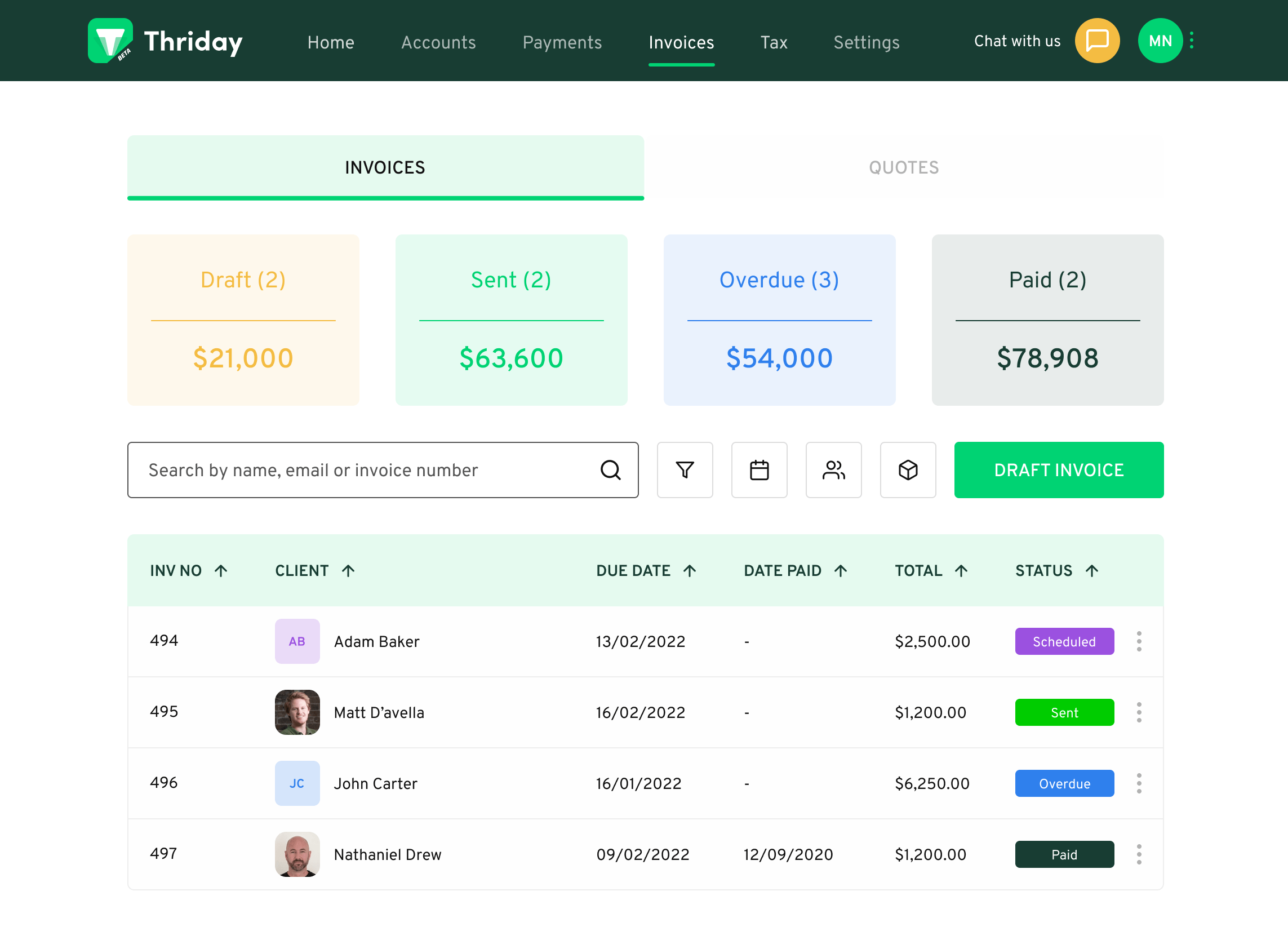

Commbank, the largest of the Australian banks, has traditionally focused on its retail customer heartland. Commbank's best offering for business relates to its suite of payment terminals. It's online and mobile banking for business offering however leaves a lot to be desired. Let's not even get started on Commbiz. If you want to take a trip down memory lane to see what websites used to look like, then jump aboard the time machine and hold on for dear life. Commbank essentially provides the same features to business owners as it offers to retail customers. If you want to step beyond the essentials, than it's time to start looking at Thriday.

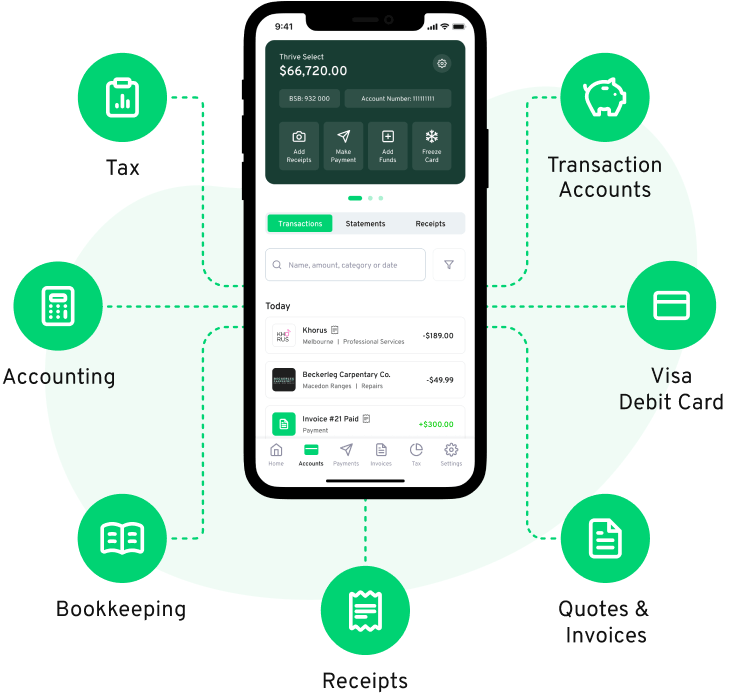

Do you get a power outage every time you look at a shoebox of receipts? Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – paying tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of everything you, leaving you in control, and all the power at your fintertips. Don’t waste another minute, get started now.