Hnry was founded in New Zealand and launched in Australia in 2021. Hnry requires you to get your income paid into a trust account, which is held in their business name. Hnry then disperse payments to your nominated bank account, minus any estimated taxes, which they forward to the ATO as you're paid. It's like the tax collector came to collect their tax early! When you consider that cash flow is king, it adds a huge burden knowing there is money literally just sitting there that you can't touch. To top it off, Hnry charges you up to $1,500 a year depending on how much you make as a business.

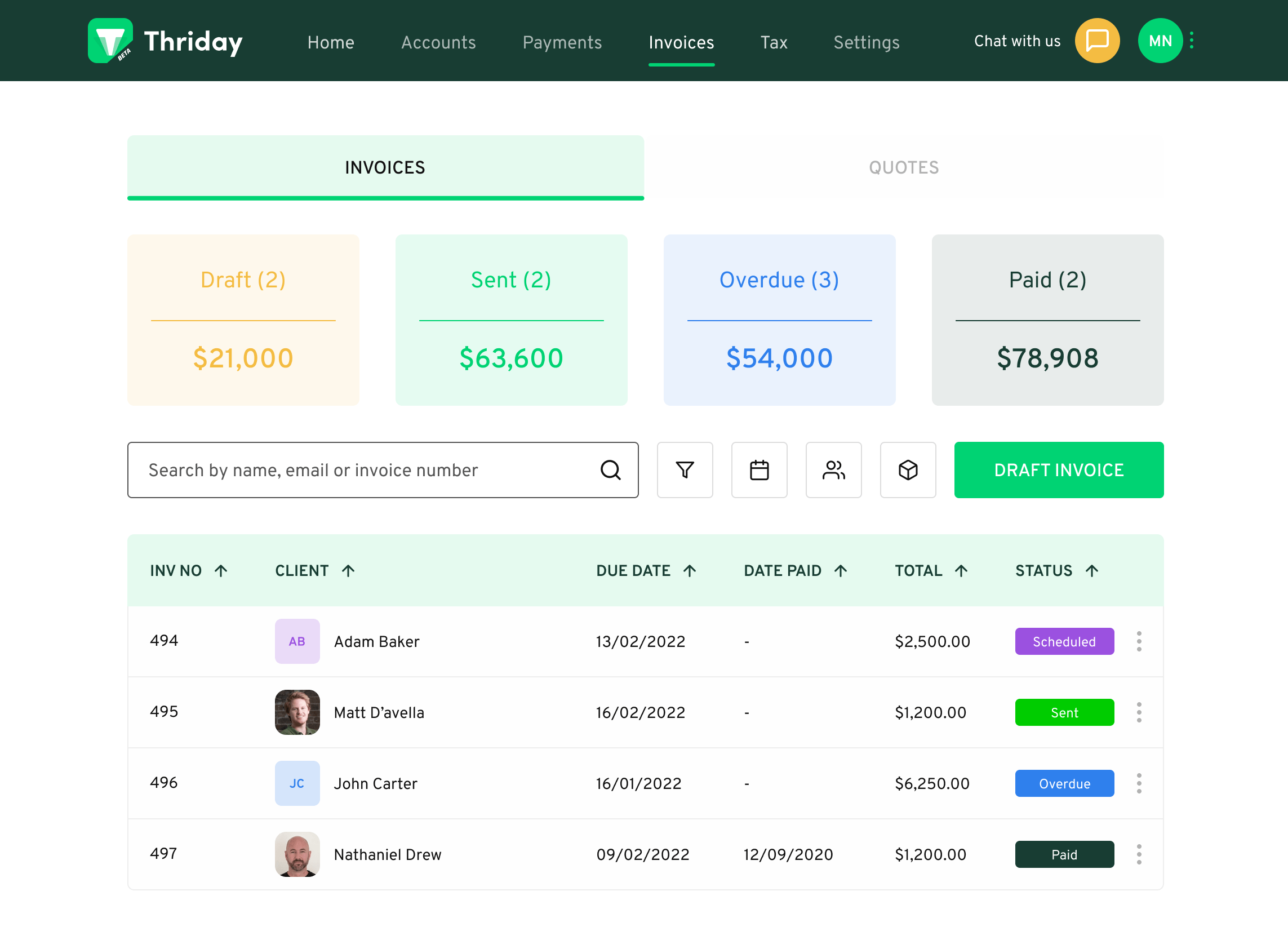

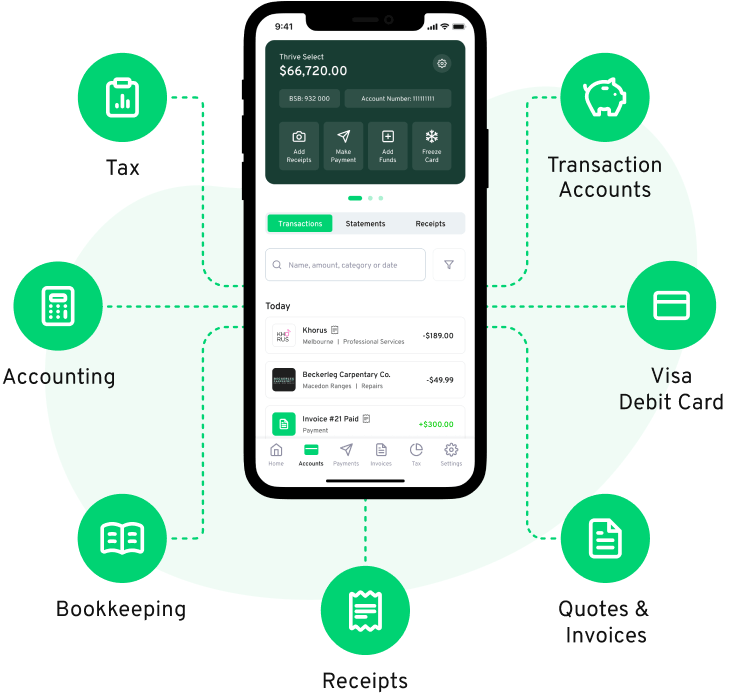

Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of all your financial admin for only $29.95 a month. Say goodbye to time wasted, and say hello to Thriday.