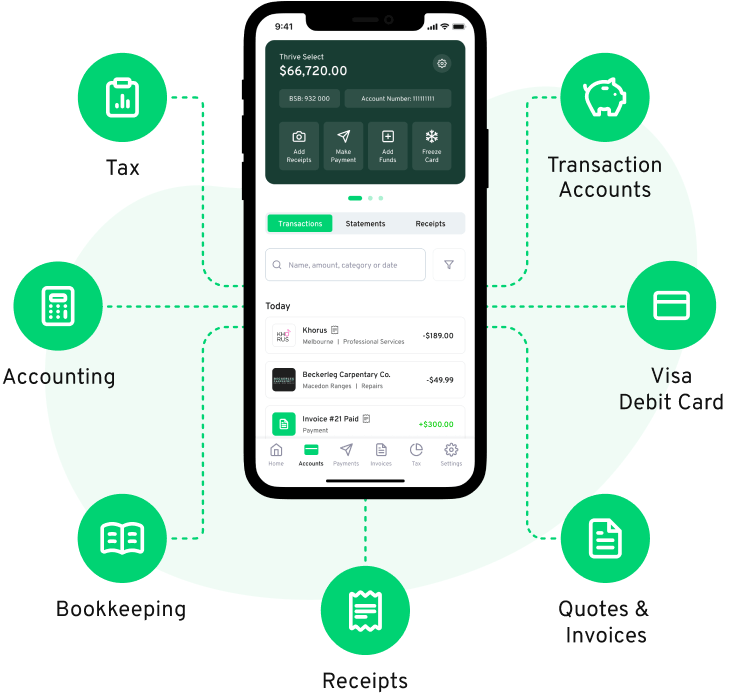

Macquarie, which by many metrics is now one of Australia's big 4 banks, provides banking services typically targeted at the large corporate end of town. Macquarie's offering is really based merchant banking, lending and investment. When it comes to small business, Thriday and Macquarie don't really compare. Thriday was designed and built by small business owners for small business owners. Having experienced the pain of managing finances via existing solutions, the Thriday team was hell-bent on doing it a better, more automated, and more intellingent way.

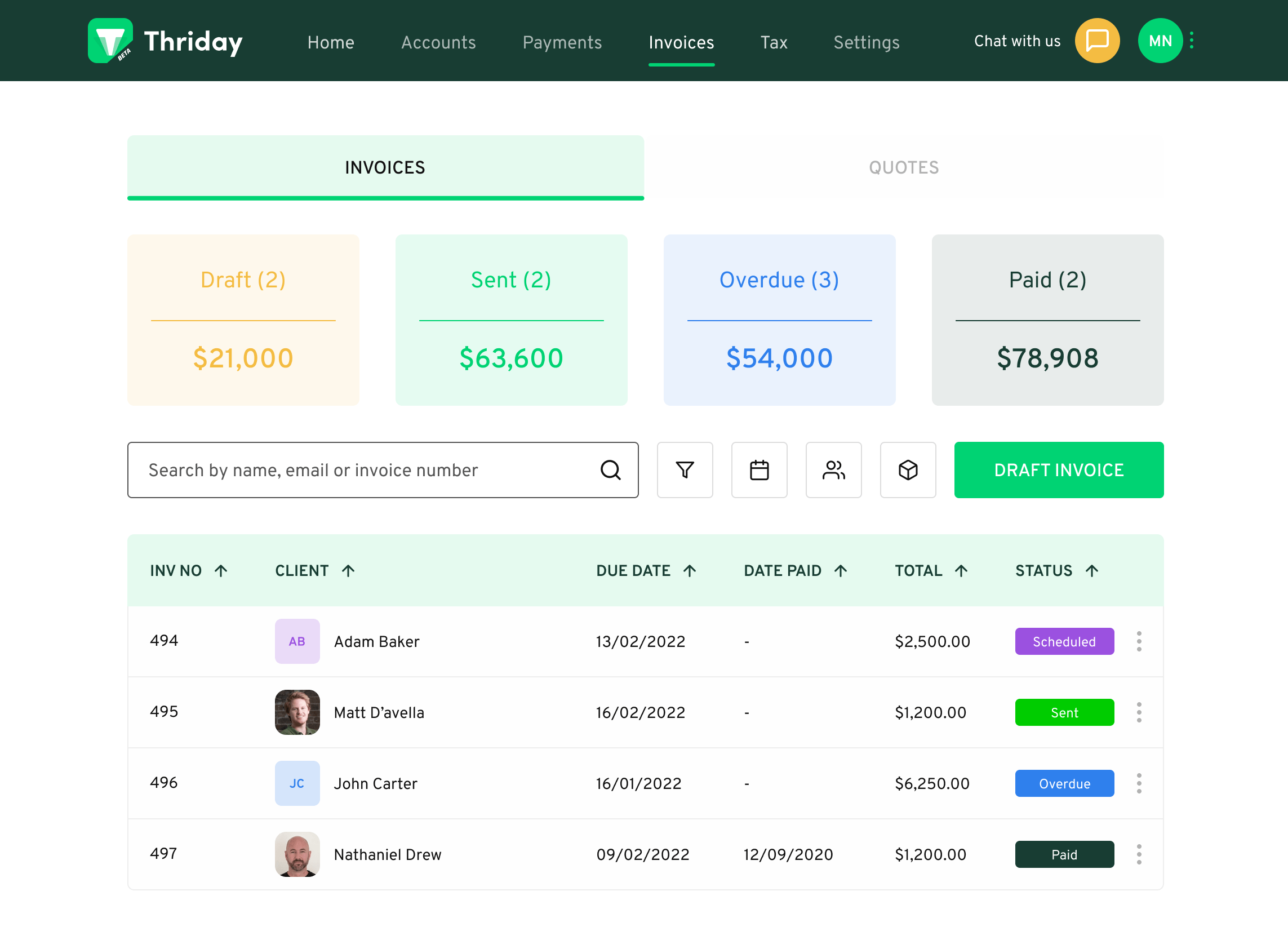

Do you love running a business but hate the 'business stuff'? Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly categorise all your transactions and apply them to a chart of accounts. This means that as you earn or spend money, all your books are processed without lifting a finger. Thriday takes care of everything for you, giving you the peace of mind to focus on what matters.