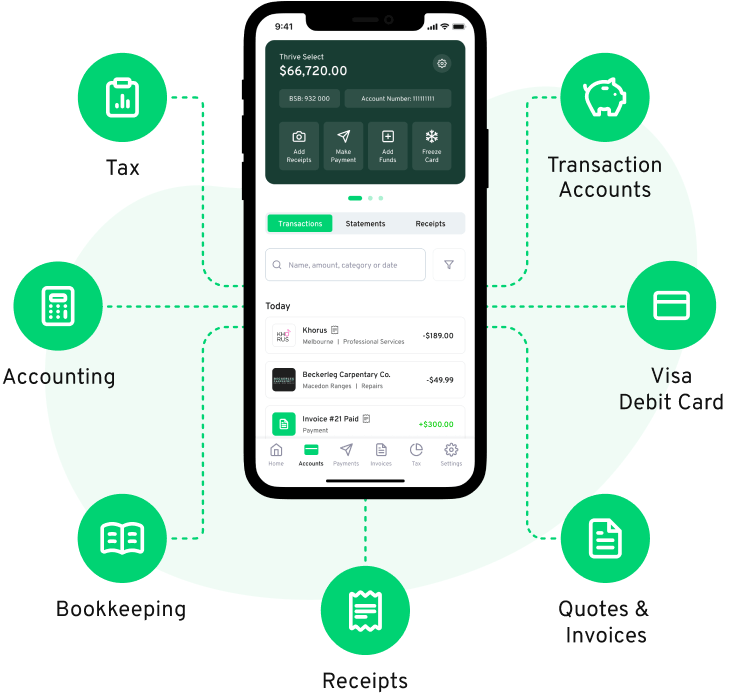

Parpera does not provide Financial Claims Scheme (FCS) guaranteed bank accounts like Thriday can. Any funds you store in your Thriday transaction account is protected by this guarantee up to $250,000 per account holder. Parpera is only available via an iPhone or Android app which makes it hard if you want to review your finances in a bit more detail. Thriday offers a desktop and mobile website, in addition to iPhone and Google apps. This means you can pick the device you prefer to access your finances. Parpera does not provide any automated bookkeeping, accounting and tax features like Thriday. With Thriday, you can lodge your BAS directly to the ATO in minutes.

Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of all your financial admin for only $29.95 a month. Say goodbye to time wasted, and say hello to Thriday.