Paytron is a tool for managing business spend. Paytron funds are not held in a FCS government backed transaction account. With Thriday, all your funds are protected up to $250,000 per account holder. Paytron is similar to Airwallex and is suited to businesses that have international suppliers and need to send money offshore. Paytron has integrations into Xero, so if you still want to pay for an accountant, all your data can be pushed into Xero. Paytron does not handle bookkeeping, accounting or tax, so you still need to use multiple systems to lodge your tax. This can lead to double-entry, manual handling and inconsistent reporting. Paytron has three different pricing packages with the most popular being $59 a month.

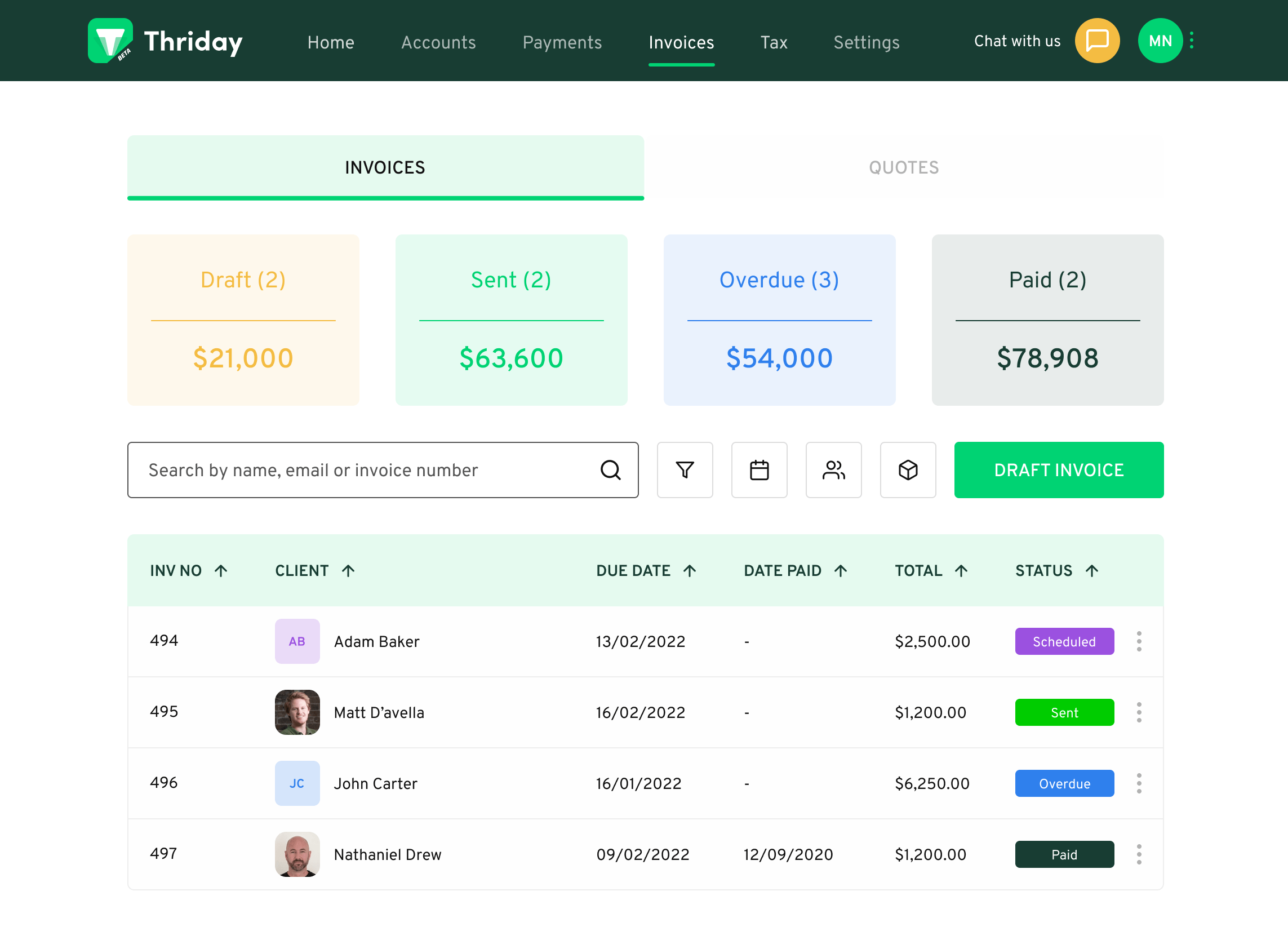

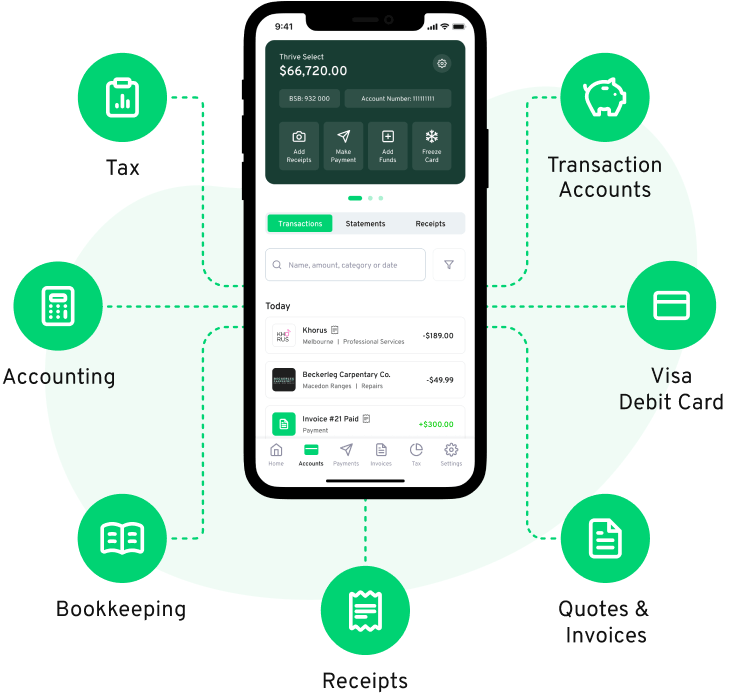

Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of all your financial admin for only $29.95 a month. Say goodbye to time wasted, and say hello to Thriday.