Rounded is focused on being a simpler, easier and sole trader focused version of traditional accounting software such as Xero or MYOB. Rounded is primarily used by freelancers and consultants. Rounded has a handy invoicing and time tracking feature but does not provide an all-in-one financial management solution. With Rounded, you will still need to use a bookkeeper and accountant. Unlike Thriday, transactions are not automatically categorised, receipts can’t be reconciled, and you can’t lodge your BAS directly to the ATO. Rounded also requires you to set up a bank feed, using screen scraping technology that requires your bank login to work. Bank feeds are notorious for missing transactions and being hard to set up.

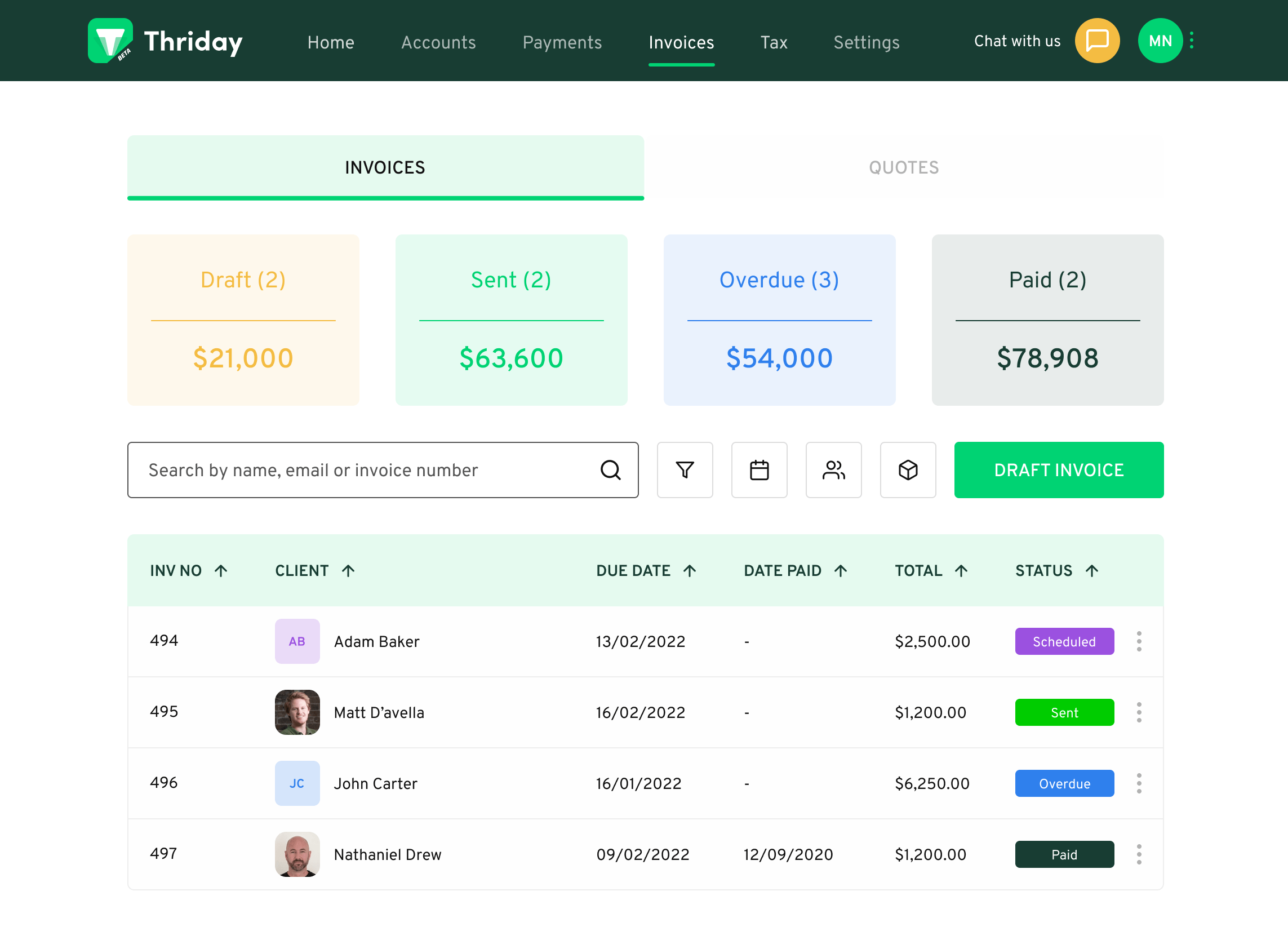

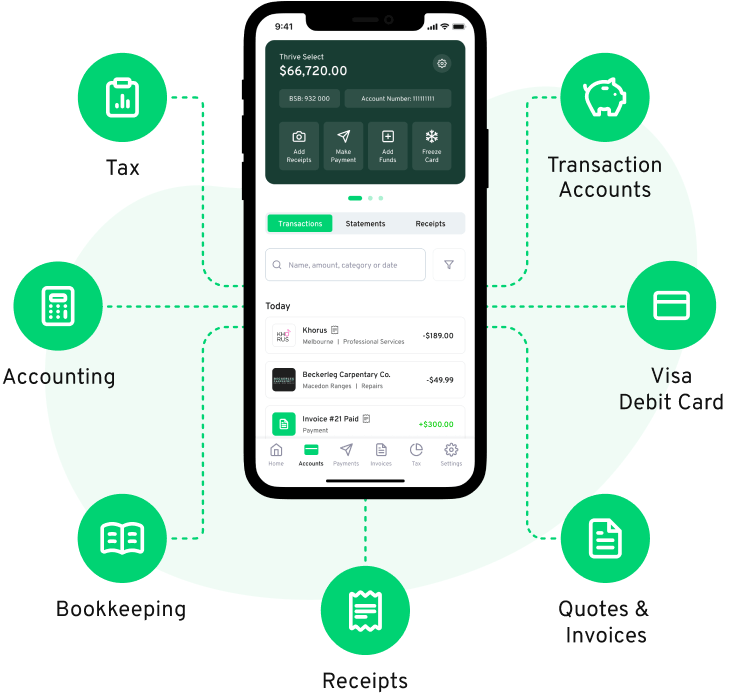

Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of all your financial admin for only $29.95 a month. Say goodbye to time wasted, and say hello to Thriday.