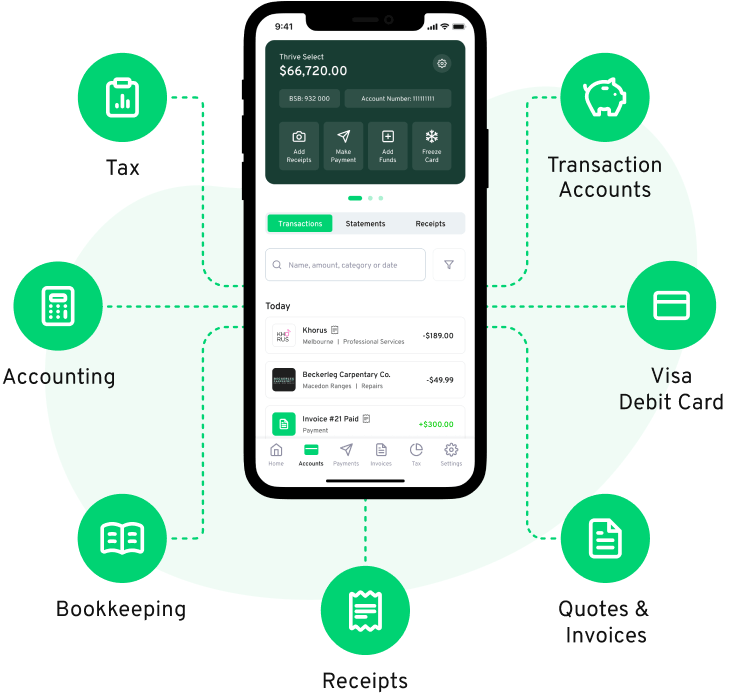

Stripe is a large US fintech that provides APIs and services to get paid. Stripe is popular with eCommerce businesses and startups who need to accept card payments online. Thriday is a great compliment to Stripe, because any payments you receive, can be paid into your Thriday business bank account* and held securely. This income is then automatically reconciled to a chart of account, and your cashflow and profit and loss is immediately calculated. Thriday can then be used to generate all your accounting reports and even lodge your BAS to the ATO.

Do you love running a business but hate the 'business stuff'? Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly categorise all your transactions and apply them to a chart of accounts. This means that as you earn or spend money, all your books are processed without lifting a finger. Thriday takes care of everything for you, giving you the peace of mind to focus on what matters.