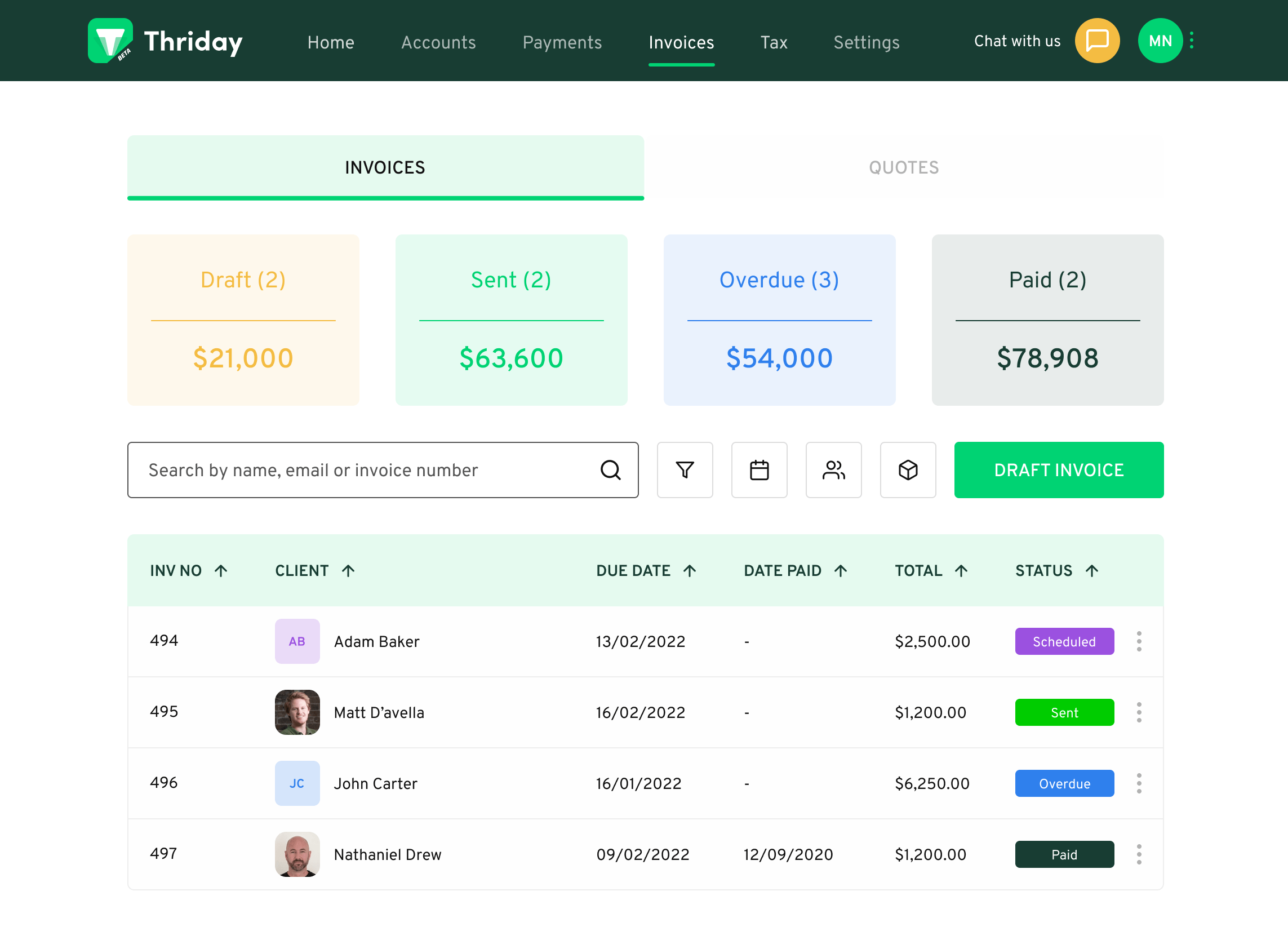

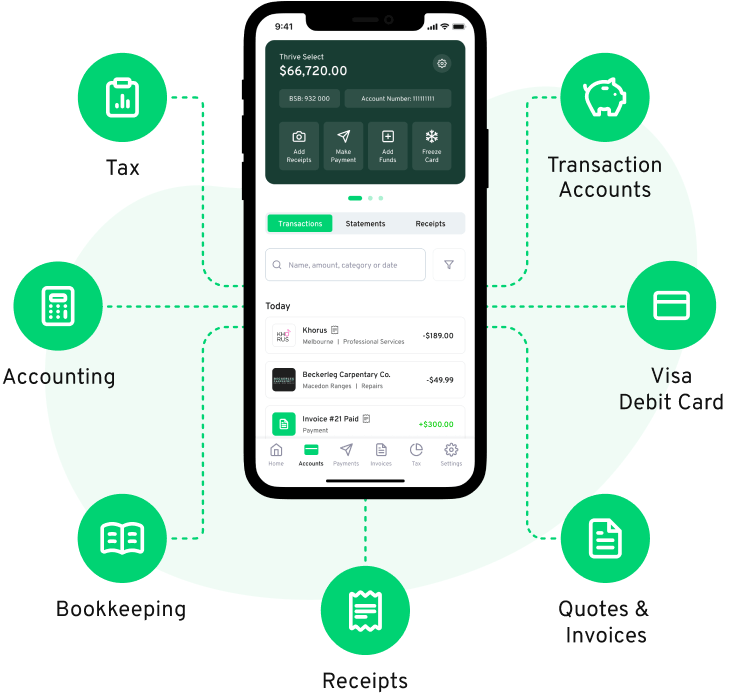

Up is a new brand under the Bendigo Bank stable that provides a retail banking service targeted at millennials. Up has proven popular with younger customers who want a great user experience and basic banking features built around their lifestyle. Thriday is a great alternative for Up customers who are looking for a business banking alternative. Like Up, Thriday provides an awesome user experience and clear information without all the fluff. Thriday is available on web and app, which is handy if you want to manage your finances anytime, anywhere. Thriday provides a number of great features for startups or entrepreneurs - features like receipt scanning, expense tracking, automated bookkeeping, invoicing and quoting and BAS lodgement. There is really nothing else you need when you sign up to Thriday.

Do you love running a business but hate the 'business stuff'? Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly categorise all your transactions and apply them to a chart of accounts. This means that as you earn or spend money, all your books are processed without lifting a finger. Thriday takes care of everything for you, giving you the peace of mind to focus on what matters.