Xero is the largest accounting software service in Australia. Xero provides services to businesses as well as accountants and bookkeepers. Xero is popular with accountants as they can use the platform to get access to their clients' banking information so that they can categorise and finalise reports for business owners. Xero has many in-depth features and as a result, is more tailored to employing businesses. Thriday is designed for sole traders and solopreneurs and as a result eliminates a huge amount of the time these businesses waste on financial admin.

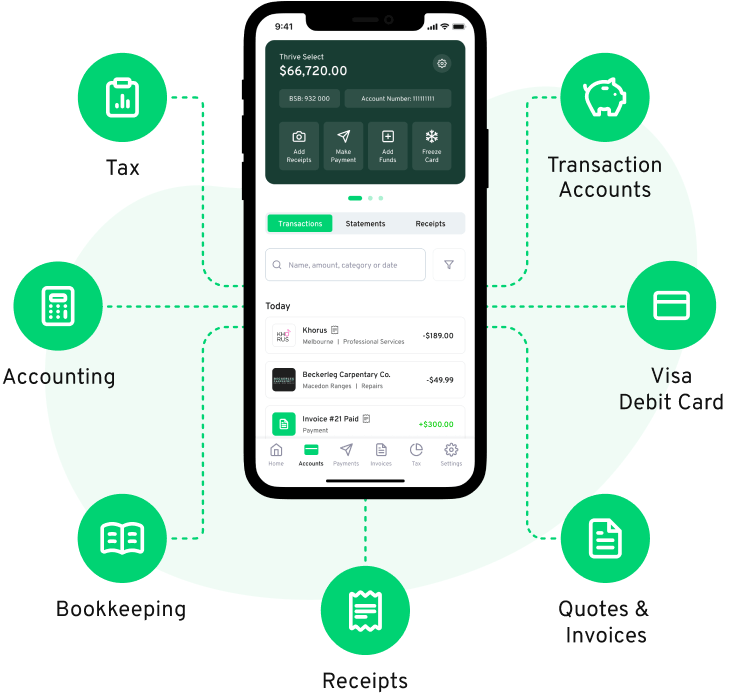

Managing your financial admin can be a real drain on your time and job satisfaction but there is a better way. Thriday is a new solution for a centuries old problem – managing your banking, accounting and tax. Thriday uses artificial intelligence to instantly interpret your transactions and apply them to a chart of accounts. This means as money hits your account, all your books are processed without lifting a finger. Thriday takes care of all your financial admin for only $29.95 a month. Say goodbye to time wasted, and say hello to Thriday.