Setting Up Bank Feeds to Accounting Software

Are you struggling with the complexities of setting up bank feeds to accounting software and the tediousness of manual data entry? In this article we'll teach you how to establish traditional bank feeds across popular platforms like QuickBooks and XERO, and introduce you to Thriday - a game-changing financial platform that is revolutionising the way Australian small businesses approach their finances. Dive in to discover how you can harness the power of automation, eliminate financial admin, and focus on what truly matters: running your business.

Setting Up Bank Feeds

What is a bank feed?

A Bank Feed is a digital bridge between your bank account and accounting software, allowing you to import your daily bank transactions into your accounting system automatically.

They offer a streamlined solution that enables the accurate retrieval of both incoming and outgoing transactions from your bank account, syncing them with your accounting activities. By properly setting up a bank feed connection to your accounting software, you can sidestep the errors and time often associated with manually inputting transaction data.

Why set up a bank feed?

The benefits of setting up a bank feed extend beyond mere convenience:

- Bank feeds can streamline the bank reconciliation process, saving time on data entry

- Transforming manual bookkeeping into an automated process with bank feeds can save time

- Integrating financial data means with certain software, you can create reports.

- With bank feeds efficiently managing transactions, you can redirect your focus to other crucial aspects of your business.

The downside of bank feeds with traditional accounting software

- Potential for errors: Bank feeds can be misinterpreted and lead to accounting errors

- Difficulty in troubleshooting: Troubleshooting problems with bank feeds can be challenging, and it may require contacting the bank or the accounting software provider for assistance

- Lack of control: Bank feeds can be delayed and time out leading to errors and the inability to do your accounting and bookkeeping when it suits you

- Security risks: Bank feeds rely on the security of the accounting software or app that is receiving the data, which can be a potential security risk

- Incompatibility with certain banks: Some banks may not be compatible with bank feeds, which can limit the usefulness of the feature

What makes Thriday different

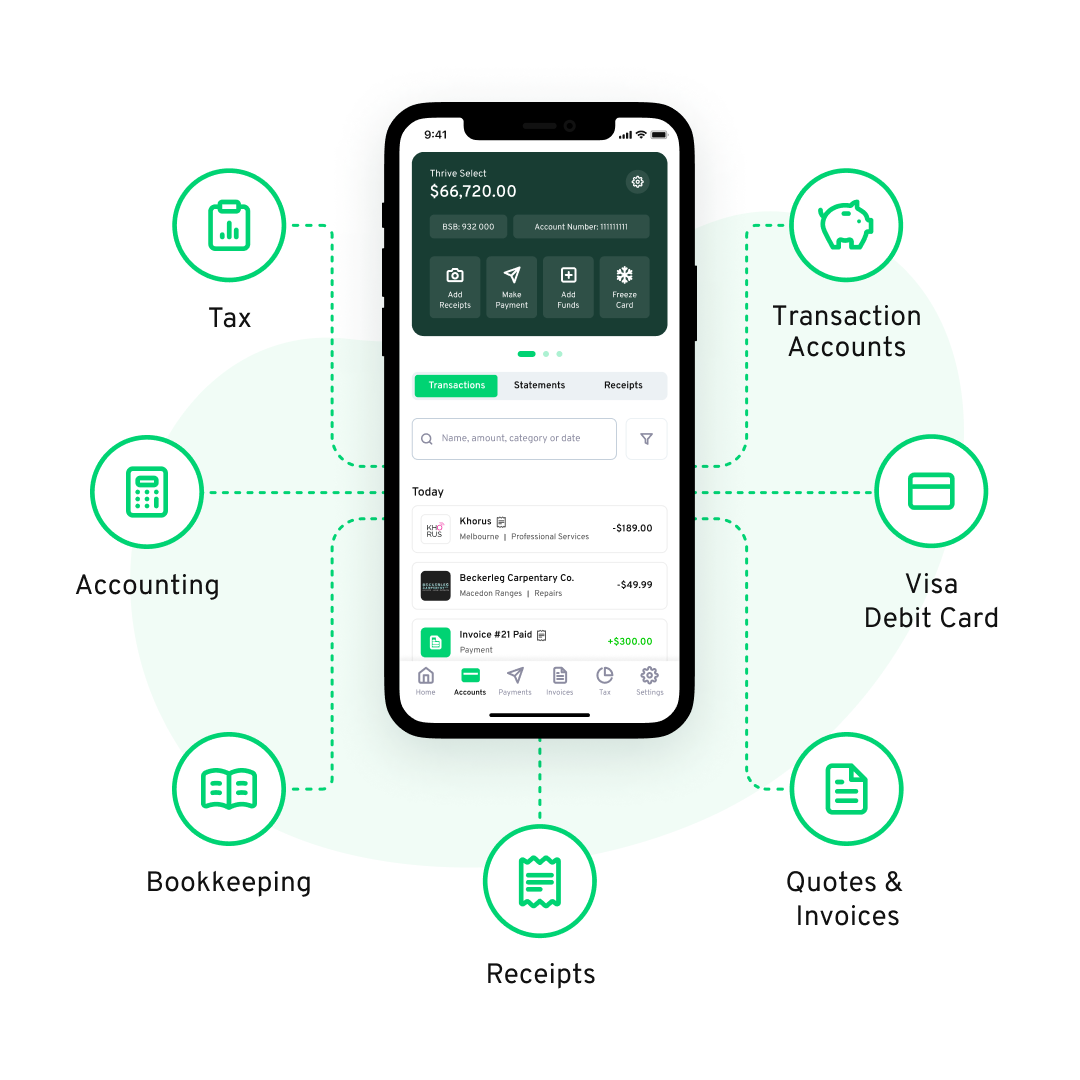

At Thriday, we have developed the ultimate all-in-one financial management platform that removes the need for external bank feeds because the bank accounts* are built in.

Not only can you say goodbye to the tedious task of manually reconciling every receipt and transaction, but you can also say goodbye to the tedious bank feed set-up process as well!

Thriday is a simple, user-friendly platform that seamlessly combines banking and accounting from the beginning so that all your financial data is safely stored and organised in one app. By combining everything in one place, Thriday can easily automate your bookkeeping and accounting needs to eliminate financial admin.

Sit back and let Thriday handle the heavy lifting, allowing you to oversee your business's financial performance with pristine clarity - all of the benefits of automation, none of the headaches of set-up!

Say no to managing multiple connections and hours wasted chasing up intricate bank feed integrations or manual imports. Reclaim control of your finances and your time with Thriday today!

What accounting software can I use?

If you do opt to use a basic bank feed, some common accounting software that allows bank feed integrations for small businesses in Australia are:

- XERO

- Desktop Super

- Eagle Shared Services

- MYOB

- QuickBooks Online

- Sage

We'll explore how to set-up these traditional bank feeds and see how they stack up against Thriday shortly.

Setting up Bank Feeds with Thriday

The beauty of the Thriday platform is that no complex bank feed set-up is needed at all!

Unlike other accounting software with complex configuration processes that have you running around gathering bank feeds and connections, Thriday is a revolutionary all-in-one financial management platform where banking happens in the same platform as your accounting - saving you the hard work so you can spend your time focusing on what you do best: running your business.

With built-in bank accounts* and a VISA debit card, Thriday offers a unique advantage to save you the time and effort of manual data gathering. With Thriday, there is no need to set up separate bank feeds and manually chase your transaction data as everything is already connected in one simple platform, where the categorisation of your transactions is automated along with your bookkeeping, accounting, and financial report generation using the power of AI.

Thriday sits at the forefront of modern accounting software to make the concept of "setting up bank feeds" obsolete. Everything you need, from transaction recording to financial analysis, is available at your fingertips, all within the integrated environment of Thriday.

Say goodbye to the complexities of traditional bank feeds and embrace the future of Tireless Transacting with Thriday's all-in-one financial solution today!

How does Thriday work?

With seamless banking integration so that all your business’s financial information is safely stored and connected simply in one platform, Thriday uses cutting-edge technology to automatically categorise and organise your transactions, managing your bookkeeping and accounting needs and eliminating financial admin. Enjoy constant and up-to-date access to your business’s financial data without the headache of external synchronisation and manual updates – available anytime, anywhere on our user-friendly mobile and web apps.

You can run your business as usual with up to 9 business bank accounts*, and the platform will automatically categorise your income and expenses. With all your transactions sorted and updated immediately in real-time in one place, the platform then easily generates the key accounting reports your business needs to thrive, all the way from a chart of accounts to tax calculations for lightning lodgment of your business activity statements!

Gone are the days of juggling multiple integrations or the frustration of discovering your bank isn't supported. Thriday seamlessly fuses banking with accounting, intelligently automating away the tediousness of bank feed set-ups.

Get started with Thriday and never worry about financial admin again!

Setting up Bank Feeds with QuickBooks

In QuickBooks Desktop, bank feeds are a powerful feature that allows businesses to connect their bank and credit card accounts for online banking. This eliminates the need for manual entry as transactions are automatically downloaded. Here's how to get started:

QuickBooks provides two main methods for linking your accounts: Direct Connect and Web Connect. Your choice will depend on your bank's offerings.

Direct Connect: Using a PIN or password from your bank, Direct Connect allows seamless downloading of electronic statements into Bank Feeds. Be aware that some banks might charge for this service. To set it up:

- Go to Banking, then Bank Feeds.

- Click 'Set up Bank Feeds for an account'.

- Find and choose your bank.

- First-time users may need to apply for Direct Connect, which some banks might need to approve.

- Once enrolled, enter your online banking details, connect to your bank's server, and pick the bank account to link in QuickBooks.

Web Connect: If Direct Connect isn't available, Web Connect lets you manually download and import a .QBO file with your transactions from your bank or credit card provider.

- Under Banking, select Bank Feeds, then 'Import Web Connect Files'.

- Open the saved .QBO file.

- QuickBooks will prompt you to pick your bank account. If it's not listed, create a new one.

- After importing, a confirmation pops up. Visit the Bank Feeds Center to check your transactions.

Modifying Settings: To update login or other bank account details in QuickBooks Desktop, deactivate your Bank Feeds, make the changes, and then re-establish your Bank Feeds.

By following these steps, you can ensure an efficient integration of your banking transactions into QuickBooks, making financial management more streamlined and effective.

If you want to streamline your financial admin and avoid the headache of bank feeds and multiple platforms altogether, Thriday can make it so!

Compare QuickBooks to Thriday here.

Setting up Bank Feeds with XERO

Xero supports four primary types of bank feeds - Direct, Yodlee, PayPal, and Stripe - with each type catering to different banking and financial needs. Before proceeding, it helps to make sure that a bank feed is available for your specific bank account – otherwise, you will need to import your transactions manually. This can be done by adding your bank in Xero and searching for its name. After confirming eligibility, follow these steps to get your bank feed up and running:

- Add Your Bank Account: Navigate to the accounting menu, select 'Bank Accounts', and then click 'Add Bank Account'. Xero will suggest popular banks for your region. Select your bank or search for it. The following steps might differ depending on your bank selection.

- Connect Your Bank Feed to Xero: Once you've added your bank account, you can connect your feed to Xero, allowing automatic import of bank transactions and reducing manual data entry.

- Manual Transaction Import: If a direct feed isn't available from your bank, you can opt to manually import transactions into Xero.

- Setting Up Automatic Bank Feeds While Adding a Bank Account: Click on 'Manage Account' for the desired account, then 'Edit Account Details'. Enter your bank's name in the 'Your Bank' field, click 'Continue', and follow the prompts to connect the bank feed.

- Setting Up Automatic Bank Feeds After Adding a Bank Account: In the accounting menu, select 'Bank Accounts', choose the account for which you want a feed, click 'Get Bank Feeds', and then follow the instructions to establish the connection.

If you are still having trouble, there are several YouTube videos that offer step-by-step demonstrations on setting up bank feeds in Xero. These can be particularly helpful if you're more of a visual learner.

Or use Thriday to save yourself the tediousness of bank feed establishment and start leveraging the AI-driven revolution of banking and accounting in the same simple-to-use platform!

Compare XERO to Thriday here.

Thriday: The Next-Gen Solution for Streamlined Financial Management

As we've explored the nature of bank feeds and integrations across various platforms, one name with a winning point of differentiation stands out: Thriday.

Not just another platform; Thriday is a holistic financial ecosystem designed with the Australian small business in mind. While traditional systems necessitate the cumbersome process of setting up bank feeds, Thriday eliminates this step entirely.

With its integrated bank accounts* and Visa debit card, Thriday offers a seamless experience where banking and accounting are matchmade from inception. This synergy ensures real-time access to financial data, eliminating the need for manual syncing, updates or juggling multiple connections. Thriday’s integrated approach represents a paradigm shift in how businesses approach their finances. It's not just about automation; it's about empowerment. With Thriday, businesses are equipped with a platform that provides clarity, efficiency, and insight, all in one place.

With automatic transaction reconciliation and financial report generation - let Thriday take the guesswork, tediousness, and, most importantly, the TIME out of financial management!

Explore how Thriday can simplify your accounting workflow today.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you. Team Thrive No 2 Pty Ltd ABN 26 677 263 606 (Thriday Accounting) is a Registered Tax Agent (No.26262416).

.svg)

.svg)

.webp)