How to Assess Risk for Your Small Business

Understanding and effectively assessing the risks your small business may face is crucial for survival and growth in today's dynamic business landscape. Business risk comes in many forms, and proactive risk management is a foundational process in preparing your business to handle uncertainties effectively and protecting its ability to thrive long into the future. In this in-depth guide, we'll explore how you can comprehensively assess business risks and introduce you to Thriday, a powerful all-in-one financial management platform that can help you identify and manage them more effectively.

Categorising Business Risk

Business risks can be broadly categorised into internal and external factors, each requiring a unique approach for identification and assessment. Here's a breakdown of the different types of risks your small business may face:

Internal Risks

Internal risks originate within the company and are often within its control. Some internal business risks are:

Operational Risks

These are risks arising from the day-to-day operations of the business. They can include system failures, process inefficiencies, or workforce challenges such as skill shortages or employee turnover. Operational risks are often within the control of the business and can be mitigated with effective internal processes and controls.

Thriday combines all your business banking* and accounting into one safe and secure integrated environment, eliminating the need to juggle multiple platforms and unreliable bank feeds to streamline processes. At the same time, the cloud-based mobile and web apps mean your data is always accessible anywhere, anytime on any device.

Financial Risks

Financial risks are associated with the financial operations of the business. They encompass challenges like cash flow difficulties, credit management, and financial planning uncertainties. These risks can stem from external market conditions or internal financial management practices. With cash flow projections, smart GST recognition to forecast tax estimates and much more as part of a next-generation all-in-one financial management platform, Thriday can help you stay ahead of these risks with real-time financial insights about the health of your business.

Strategic Risks

These risks are linked to the high-level decisions and strategies that define the direction and scope of the business. They include risks related to market positioning, business model changes, and competitive landscape shifts.

Thriday's automated financial reporting gives you a bird's eye view of your small business's financials without the tedious financial admin, giving you a clear and continuously updated picture of your business to take your strategic decision-making to the next level.

External Risks

External risks are those that arise from outside the business and are typically beyond direct control. These can include:

Market Risks

Market risks involve changes in the external business environment. These can include shifts in consumer demand, economic fluctuations, or changes in market trends. Market risks are often beyond your direct control, but with Thriday's automated accounting providing business insights that are continuously updated with every transaction, the clarity you need to adapt to these changes more effectively is at your fingertips.

Legal and Regulatory Risks

These risks are related to changes in laws, regulations, and compliance requirements. They can have significant implications for how your business operates and can vary widely depending on the industry and geographical location.

Environmental Risks

Environmental risks encompass factors like natural disasters, climate change impacts, and political instability. These risks can disrupt business operations and supply chains and are increasingly a concern for businesses globally.Assessing and Prioritising Risk

Once potential risks to your business have been identified, the next critical step in risk management is to assess and prioritise these risks.

This process involves a thorough evaluation of each risk in terms of its potential impact and likelihood of occurrence and can benefit from the integration of smart tools like Thriday to aid in monitoring and managing these risks.

This assessment is vital for understanding the severity and urgency of each risk, enabling you to allocate resources effectively and develop appropriate mitigation strategies.

Evaluation of Impact and Probability

Understanding Impact

The impact of a risk refers to the extent of damage or disruption it can cause to the business. This could range from minor inconveniences to significant threats that could jeopardise the business's survival. Factors to consider include financial loss, reputational damage, operational disruption, and legal liabilities.

Thriday's comprehensive financial reporting can provide valuable insights into these areas, highlighting vulnerabilities and potential impact areas in your financial operations, such as cash flow or upcoming tax positioning.

Assessing Probability

Probability assessment involves estimating the likelihood of a risk occurring. This may require an understanding of various factors such as historical data, industry trends, and current market conditions. It's important to note that some risks might be rare but catastrophic, while others could be frequent but with minimal impact.

Prioritisation of Risks

High-Impact, High-Probability Risks

Risks that are both highly likely to occur and have significant impacts should be addressed first. These require immediate attention and robust mitigation strategies to prevent or minimise their effects.

Thriday's financial forecasting can help you identify these risks early, allowing for prompt and effective mitigation strategies.

Moderate Risks

Risks with moderate impact or probability should be carefully monitored and managed. Plans should be in place to address these risks should they escalate in severity or likelihood.

Thriday's platform can be instrumental in tracking these risks, providing updates and insights in real-time to inform timely decision-making.

Low-Impact, Low-Probability Risks

While these risks are less of a concern, they shouldn't be ignored. Continuous monitoring is essential to detect any changes in their status that might increase their threat level.

Continuous Risk Assessment

Risk assessment is not a one-time activity but a dynamic process. The business environment is constantly evolving, and new risks can emerge while existing ones can change in severity or likelihood. Regular reviews and updates to the risk assessment are crucial to ensure that the business remains prepared and responsive to any changes in the risk landscape.

Thriday's platform facilitates this dynamic process by providing up-to-date financial data and analytics, ensuring that your business's risk management strategy remains relevant and responsive to the ever-changing business environment.

Identifying and evaluating business risks is a multi-faceted process that requires careful consideration of both internal and external factors. By evaluating the impact and probability of each risk and prioritising them accordingly, you can focus your efforts on the most pressing threats, ensuring that resources are used efficiently and effectively to safeguard the business's interests.

Thriday: Enhancing Risk Management with Streamlined Financial Admin

What is Thriday?

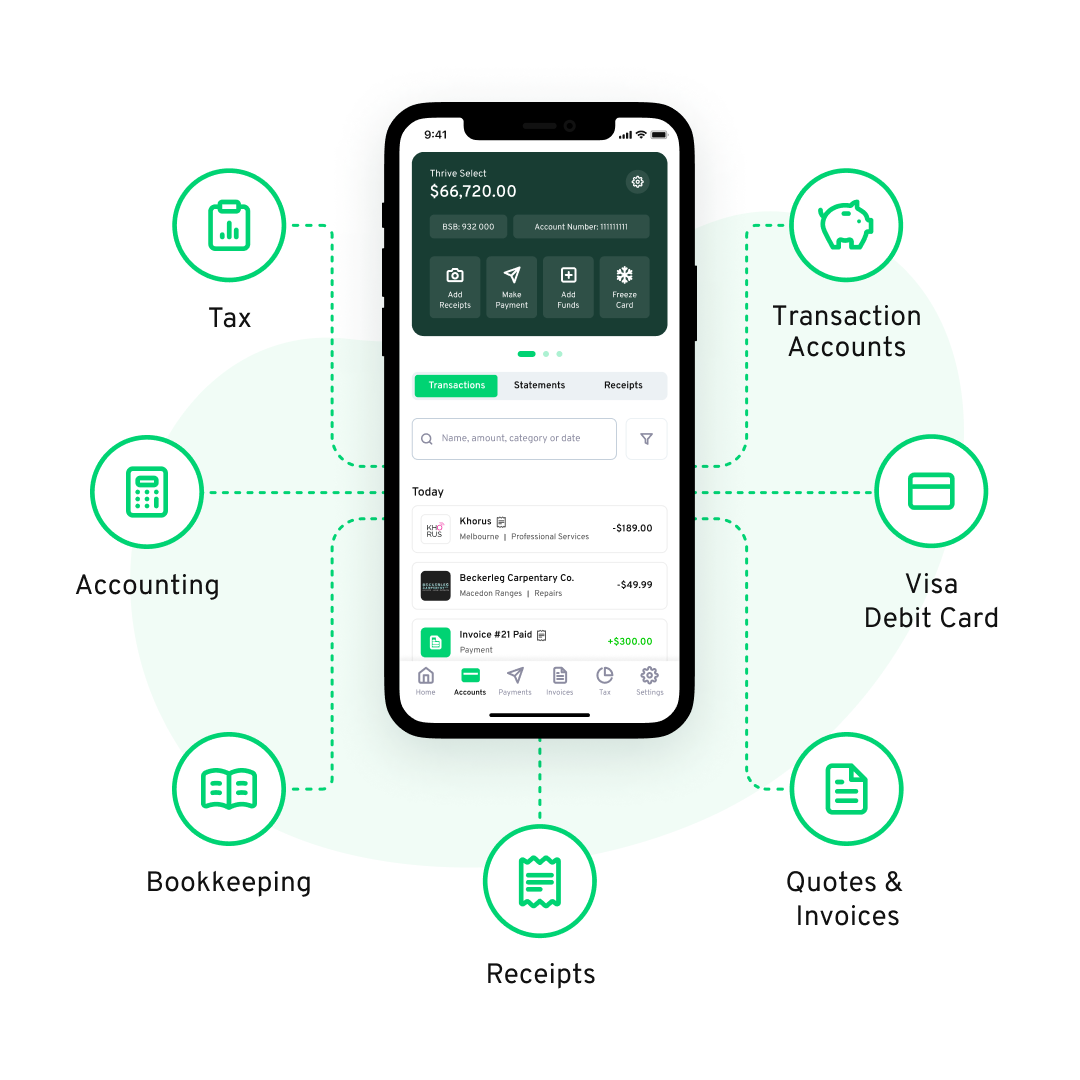

Thriday is a comprehensive all-in-one financial management tool that leverages the power of AI to automate the financial administration process and revolutionise the way businesses handle their bookkeeping, accounting, and financial reporting.

The platform seamlessly integrates business transaction accounts* and a VISA debit card with invoicing, bookkeeping, and accounting software in one user-friendly platform to streamline financial organisation, reduce administrative burdens, and offer real-time insights into your business's financial health.

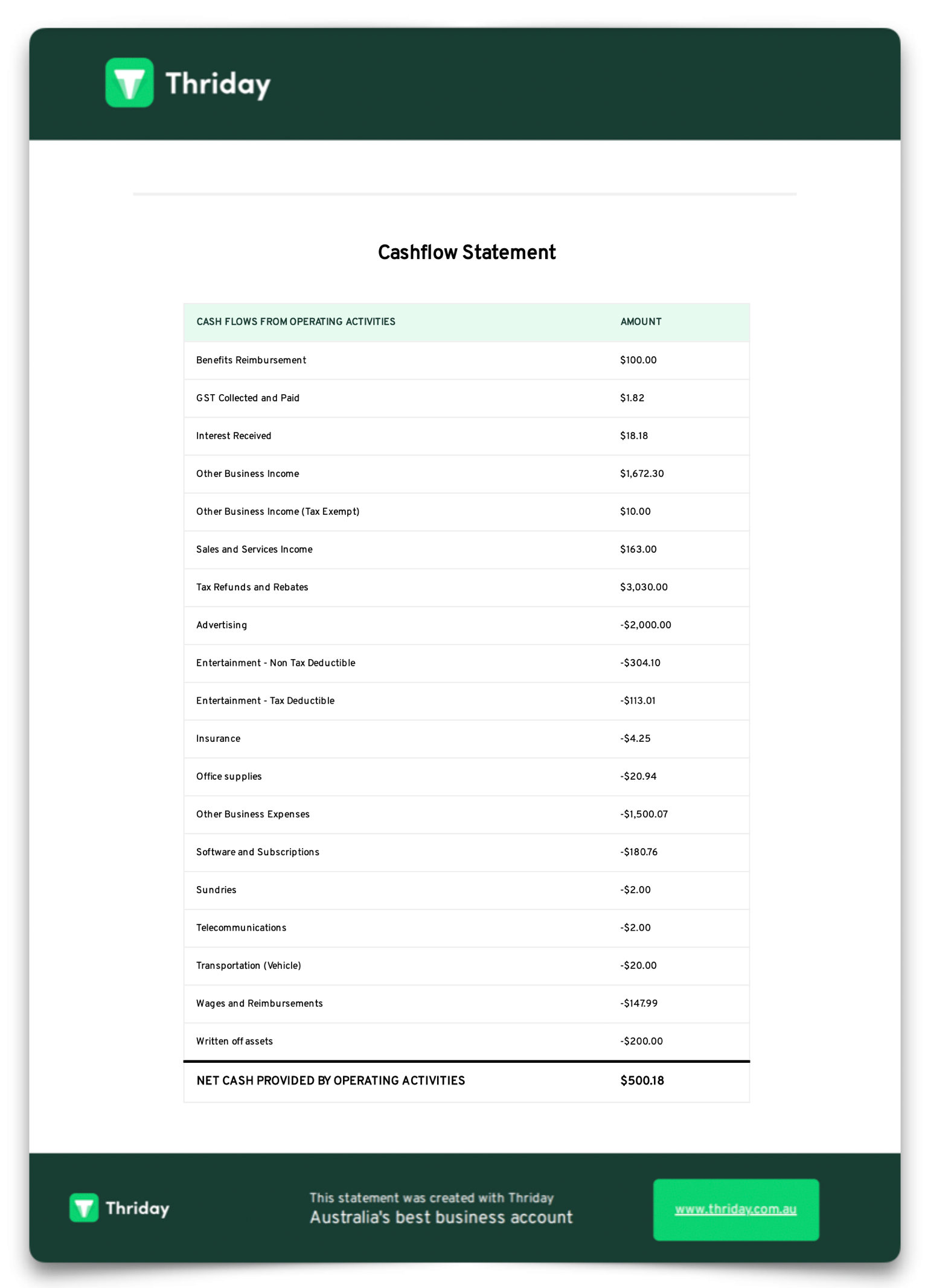

Run your business as usual with up to 9 business bank accounts*, and the platform effortlessly categorises your income and expenses as they occur. This real-time, automated sorting and updating of all your transactions in one integrated environment enables the platform to automatically generate the key crucial accounting reports essential for your business's success – ranging from detailed cash flow and income statements to tax calculations, facilitating quick and efficient lodgment of your Business Activity Statements with the click of a button with the app!

Improving Risk Management with Thriday

Here's how the Thriday platform can help your small business effectively manage business risks:

Real-Time Financial Insights

Thriday's seamless integration with business transaction accounts* and a VISA debit card with accounting software allows for real-time monitoring of financial activities. This immediate access to categorised and summarised financial data, such as cash flow projections and tax estimates, is crucial for identifying and responding to financial risks promptly, ensuring that you can make informed decisions quickly to mitigate potential threats.

By automating the accounting process, Thriday provides accurate and up-to-date financial reports. These reports are essential for assessing the financial health of your business, allowing for a more precise evaluation of financial risks. The platform's AI-driven reconciliation and categorisation of transactions means that businesses have a clear, current view of their financial standing, which is vital for effective risk management.

Receipt Reconciliation

Thriday's receipt management feature simplifies tracking business expenses, a key aspect of financial risk management. Simply snap a photo of your receipts, and the platform can easily capture, store, and reconcile them with the rest of your financial information. This aids in maintaining accurate financial records, which are essential for identifying and addressing cost-related risks, as well as verifying and validating tax deductions if you're ever faced with a review or audit by the ATO.

The platform's ability to handle all the elements of financial admin in one safe and secure platform reduces the operational risks associated with manual accounting and record-keeping. Gone are the days of trying to piece together financial information from endless data sources, juggling multiple platforms and dealing with nasty error-prone bank feeds! This reduction in administrative burden saves time and decreases the likelihood of errors that can lead to financial discrepancies and increased risk.

Incorporating Thriday into your small business's risk management strategy can significantly enhance the business's ability to monitor, assess, and respond to various financial risks.

With its comprehensive suite of financial management features, Thriday supports you and your business in maintaining a robust risk management framework, protecting the stability and growth of your enterprise.

Key Takeaways: Navigating Business Challenges with Confidence

Effective risk management is crucial for the stability and growth of any small business. By identifying, evaluating, and prioritising risks, you can protect your business from potential threats and operate more confidently.

Integrating Thriday into your risk management strategy simplifies this essential process. Thriday's AI-driven platform seamlessly combines banking* and accounting to provide real-time financial insights and automated accounting, making monitoring and responding to financial risks easier. At the same time, efficient receipt management and streamlined financial administration work to reduce the likelihood of human errors and enhance overall financial health.

With Thriday, risk management becomes less about navigating complexities and more about leveraging a clear and actionable view of your business's financial health to handle risks before they become a problem. This approach empowers you to make informed decisions quickly now rather than later, ensuring your business is well-equipped to handle any challenges the competitive business landscape may throw at it.

Get started with Thriday today to take your business to the next level!

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you. Team Thrive No 2 Pty Ltd ABN 26 677 263 606 (Thriday Accounting) is a Registered Tax Agent (No.26262416).

.svg)

.svg)

.webp)